MP&Co has worked alongside GMB Credit Union to transform their marketing over the last 4 years, helping the business continue to grow during challenging times for many companies.

GMB Credit Union is the financial arm of GMB Union, a trade union with 620,000 members spanning a range of professions and backgrounds across the UK. Established to support members’ economic wellbeing, GMB Credit Union offers fast, fair and affordable loans and lending solutions.

Like the union itself, GMB Credit Union is wholly owned and run by GMB members, so its focus is always on members’ financial wellbeing, rather than profit.

Find out what they do and how our expert help has helped to steer a strategy that’s not only transformed their outlook but driven exceptional results.

GMB Credit Union approached MP&Co at the end of 2019, as a referral from one of our existing clients. The organisation had never done any marketing before, despite being an established business.

Therefore, its management was looking for a partner to create and execute a marketing strategy that would enable the credit union to communicate with its wide audience, at scale – as well as digitising its current products and services.

We also needed to be cautious as they’re an institution that provides support and financial assistance to members during a time of deep financial worry.

How could we help communicate with GMB Union’s 620,000 members and educate them on the benefits of joining its credit union?

GMB Credit Union had no formalised way of contacting GMB members and no internal marketing function. So, we faced the challenge of establishing and maintaining clear channels of communication that would enable GMB Credit Union to tap into the member base to grow the business.

Once a strategy was up and running, how could we help GMB Credit Union flex to adapt to the changing circumstances of COVID-19 as well as cost of living crisis being thrown into the mix?

All over the world, we saw people struggling with redundancies, furlough, job insecurity and financial hardship: therefore, how could we harness GMB Credit Union’s enhanced offering to support individuals and families through the devastating impacts of the pandemic and cost of living crisis?

How to present GMBCU as a modern and leading financial institution?

Amidst industry uncertainty and widespread cost-of-living crisis, the challenge lies in how GMBCU can effectively convey itself as a modern and leading financial institution. It’s crucial for GMBCU to reassure its members and demonstrate unwavering support in navigating diverse economic challenges.

To kick-off, we launched our strategy project, taking a deep dive into the business and striving for complete clarity on its target audience, objectives, ambitions and opportunities.

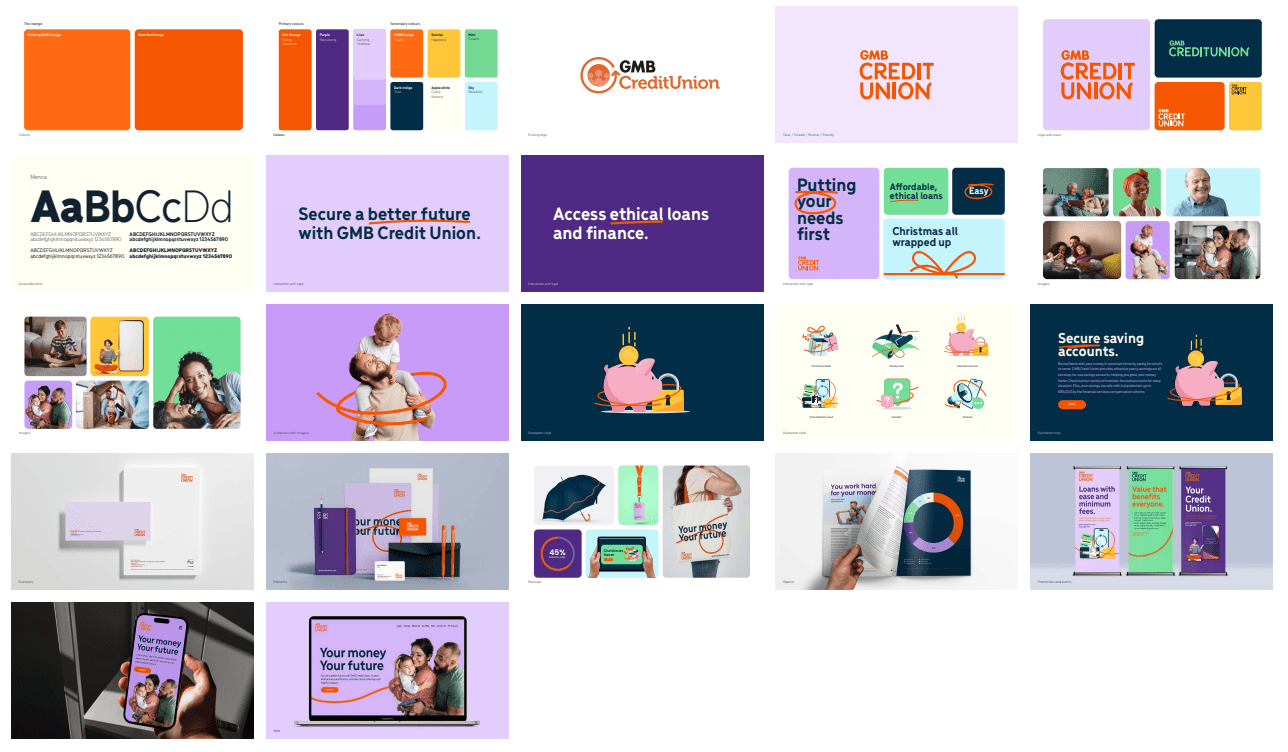

During this process, we identified several key areas where GMB Credit Union required the most support: defining the brand and what it stands for and how to use marketing collateral to bring that brand to life. We also needed to ensure we communicated its core messages in all content to their members. This ensured their messages were consistent and to stop any confusion that may be caused to their members.

The core messages were simple. GMB Credit Union helps its members make considered, well-informed and sensible financial decisions, offers them a fair and competitive alternative to risky payday loans or expensive lending products and provides members with fair savings rates.

The next part of the process was to create a plan to share those messages across different platforms in a powerful, and cohesive way.

Many of these channels didn’t even exist yet, as GMB Credit Union had no blog, advertising platforms, social presence or following. So, we formulated a comprehensive strategy to cover all bases and start shouting about the credit union to all the right people, in all the right places.

Our strategy saw us:

After a few years of collaboration, it was time to review GMBCU’s marketing strategy to ensure its key messages and positioning are still aligning with its business strategy. To maintain their position as industry leaders, it was crucial to be in the loop of current trends.

That’s why we conducted a marketing strategy review in 2023. This led to a brand refresh which included:

The brand refresh at GMBCU was motivated by the desire to maintain competitiveness, align with business objectives, and enhance the brand’s appeal through updated visuals and messaging across various marketing channels. Given the numerous changes in circumstances over the past 4 years of economic situation, this update was necessary.

Throughout our journey with GMB Credit Union, its approach to its customers remained consistent: GMB Credit Union cares about its members and their financial security and freedom and wants to empower them to enjoy a more fulfilling financial lifestyle.

Therefore, we mirrored this supportive, honest approach to roll out a long-term, multi-channel strategy to create real momentum to grow the business. We left no stone unturned in our mission to harness a range of marketing measures to promote GMB Credit Union’s offering consistently and dynamically.

As always, our collaborative approach to marketing was enhanced by regular, digestible and insightful reporting and communication to give the client clarity and impetus to drive growth. As well as giving GMB Credit Union the means and momentum to get their message out to a broad audience across multiple channels, we set up tracking and analysis to provide regular data to help the company make informed, strategic decisions.

Previously, this didn’t exist in the business, so it enabled management to gain insight into what works and how to move forward.

Since we started to work with GMBCU the business has seen more than 100% growth in terms of memberships and a continued growth in revenue.

When the COVID storm hit, we supported GMB Credit Union to quickly bring to market an enhanced loan package designed to help members access fast, fair, and affordable funding that’s built around their financial wellbeing when they need it most. The same approach has been applied following the cost-of-living crisis.

Key achievements as a result of our work include:

Beyond this, MP&Co has stayed conscious of its instrumental role in supporting GMB Credit Union’s duty of care to its members, inspiring them to make smart borrowing decisions and safeguard their long-term financial future, through our thoughtful educational content strategy.

MP&Co are simply very good at what they do and they are great to work with.

We have been working with Mike and his very professional team for over twelve months during which time our business has grown significantly, despite the pandemic. In that short time, they have successfully repositioned our brand, developed a dynamic digital marketing strategy and greatly enhanced our communications with customers and key stakeholders.

We would have no hesitation in recommending Mike and his team who are honest, straightforward and very focused on adding value to the business through a commitment to continual measurement and improvement on all marketing activity.

Hans Billman, CEO, GMB Credit Union